[responsivevoice_button voice="US English Female" buttontext="Listen to this Article"]

In just weeks, the Coronavirus pandemic has shaved off nearly a third of the global market cap leaving the markets to collect the outrageous aftermath of the unprecedented scare. The global economy continues to take the big hit as a number of active cases spiral across the world, shaking the confidence of investors and industrialists. In its daily situation report on the pandemic, the WHO said total of 381,653 cases and 16,658 deaths were reported. All the investment tactics come to a stand, with the corona fear eroding the value of the lifetime accumulated wealth. Apart from the equity and debt markets, currency and commodity markets are in turmoil too due to adjoined implications of the crude oil war. Investors are selling off silver and gold trying to hoard maximum cash to back them up until things return to normal. And this has put even gold in a bearish atmosphere. Sensex hit a lower circuit limit of 10 percent twice within one month as coronavirus scare continued to weigh on the sentiment. Market capitalization of BSE-listed firms retreated to Rs. 105.91 lakh crore from Rs 116.09 lakh crore. The disruptions of trade with China and spill over from the staggering global growth have furthermore put the Indian macroeconomic outlook in a vulnerable position.

Covid-19 has not just crashed asset prices and stock markets, but real lives and real activity. Businesses have been forced to stop operations; there is loss of production across the board. The projections for world GDP 2020 have fallen below 2.5%. There is a little doubt we are starting into a recession, likely to manifest fully next year. This won’t be a stop and start cycle, because the real economy is actually interwoven and interdependent.

With the number of cases rising every day, India is at a very critical stage. Pharma producers and distributors have a crucial role to play in combating the challenge of coronavirus. Not only does the industry need to ensure maintenance of supply lines of essential medicines, medical kits and equipment, but at the same time should try to come up with new and innovative solutions. But at the same time, Indian pharmacy sector has been severely impacted by the outbreak of coronavirus in China.

According to ICRA the outbreak caused major lockdowns and shutdown of production sites in China which in turn caused shortage of drug materials serving as raw materials in the production of various medicines and thus affected Pharma sector. Even if alternate sources can be used for medicines, China still remains the preferred choice from an economical point of view.

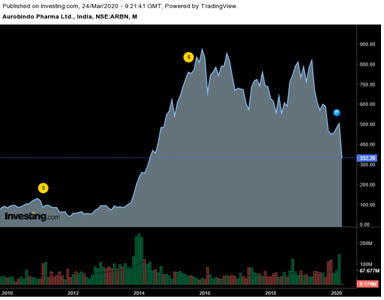

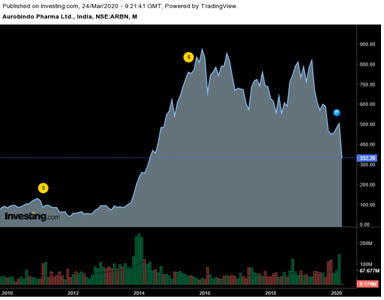

The firms are warning of drug shortages if the communist nation, which is the major supplier of pharmaceutical ingredients to India, doesn’t resume exports. The pharmaceutical companies are now close to exhausting their supply of raw material such as active pharmaceutical ingredient (API) which is an active ingredient in a pharmaceutical drug or pesticide that is biologically active. India sources about 65-70% of API and close to 90% of it from china. With such supply shortages, the prices have surged around 20-30% giving the pharma sector a tough time. Few major players of the pharma sector like Aurobindo pharma (which rallied for more than 1000 percent), IPCA, Solara active pharma are likely to suffer due to the shortage too. Aurobindo pharma’s stock price has broken down from upward slopping trend line, adjoining the lows of 14-Nov-19 and 01 Feb 2020. On the daily chart, the stock price has broken down on Monday where it closed at one month low with higher volumes. Weakness on daily and weekly charts has been reported by Oscillators and Momentum indicators.

Here is the activity of few volatile stocks due to COVID-19 (volume traded for that day) –

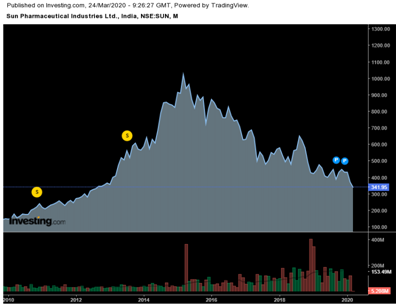

With these trends in the past month, the trend line shows that it is been on decreasing line.

In the beginning the pharma sector had witnessed a growth potential gaining the investors’ confidence which seems to go down since the supply shortage. But the picture is likely to improve due to the following reasons. India is committed to spend nearly Rs 10,000 crore ($1.3 billion) to encourage companies to manufacture pharmaceutical ingredients domestically after the coronavirus outbreak disrupted supply chains. Lockdowns in china have started to ease which help resuming the business activities in India. Along with this, domestic firms will be revived which had previously shut down due to low cost imports from china. This will in turn ease out the burden to a large extent. In the wake of recession, it won’t be long until investors start looking at pharma stocks for future investments.

With the pandemic strengthening its grip in India, now the phase has come where it is the turning point for the country; from here onwards, India can become either Italy or China. These times are extremely essential for Indian economy and in order to release the country from the grip of COVID-19, Indian pharma sector has an important role to play. This sector is bound to enjoy investor confidence at this time as it will play an important role in preventive measures. Due to increasing government intervention in this sector, investors will surely look up to this as a profitable investment opportunity. Moreover, an increase in centers for testing the disease would increase demand for equipment as well as help controlling the spread of the virus. The race of developing the vaccine has already begun and once it is done, and it will surely bring fortunes for pharmaceutical companies. Talking of Indian markets, in times like these where supply is not adequate enough to raise the demand, monetary policy loses its power, so everyone is expecting fiscal measures from FM Nirmala Sitharaman which will hopefully serve the purpose.

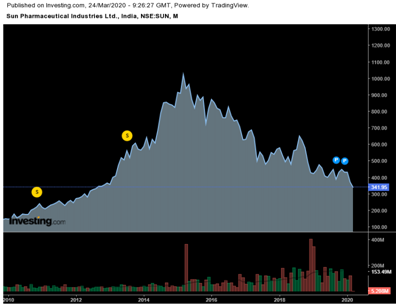

With these trends in the past month, the trend line shows that it is been on decreasing line.

In the beginning the pharma sector had witnessed a growth potential gaining the investors’ confidence which seems to go down since the supply shortage. But the picture is likely to improve due to the following reasons. India is committed to spend nearly Rs 10,000 crore ($1.3 billion) to encourage companies to manufacture pharmaceutical ingredients domestically after the coronavirus outbreak disrupted supply chains. Lockdowns in china have started to ease which help resuming the business activities in India. Along with this, domestic firms will be revived which had previously shut down due to low cost imports from china. This will in turn ease out the burden to a large extent. In the wake of recession, it won’t be long until investors start looking at pharma stocks for future investments.

With the pandemic strengthening its grip in India, now the phase has come where it is the turning point for the country; from here onwards, India can become either Italy or China. These times are extremely essential for Indian economy and in order to release the country from the grip of COVID-19, Indian pharma sector has an important role to play. This sector is bound to enjoy investor confidence at this time as it will play an important role in preventive measures. Due to increasing government intervention in this sector, investors will surely look up to this as a profitable investment opportunity. Moreover, an increase in centers for testing the disease would increase demand for equipment as well as help controlling the spread of the virus. The race of developing the vaccine has already begun and once it is done, and it will surely bring fortunes for pharmaceutical companies. Talking of Indian markets, in times like these where supply is not adequate enough to raise the demand, monetary policy loses its power, so everyone is expecting fiscal measures from FM Nirmala Sitharaman which will hopefully serve the purpose.

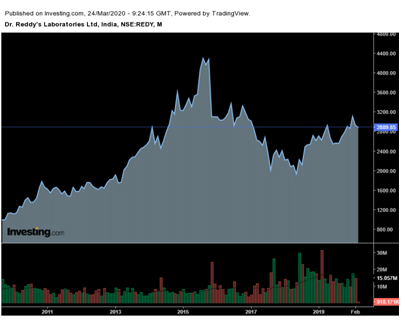

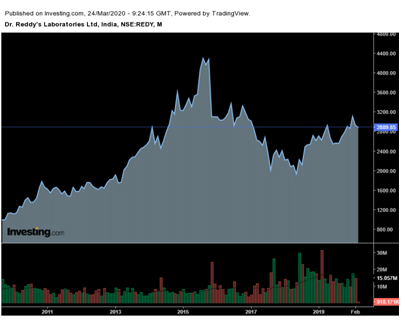

- Reddy’s Laboratories Ltd.

- Sun pharmaceutical industry ltd.

- Aurobindo Pharma ltd.

With these trends in the past month, the trend line shows that it is been on decreasing line.

In the beginning the pharma sector had witnessed a growth potential gaining the investors’ confidence which seems to go down since the supply shortage. But the picture is likely to improve due to the following reasons. India is committed to spend nearly Rs 10,000 crore ($1.3 billion) to encourage companies to manufacture pharmaceutical ingredients domestically after the coronavirus outbreak disrupted supply chains. Lockdowns in china have started to ease which help resuming the business activities in India. Along with this, domestic firms will be revived which had previously shut down due to low cost imports from china. This will in turn ease out the burden to a large extent. In the wake of recession, it won’t be long until investors start looking at pharma stocks for future investments.

With the pandemic strengthening its grip in India, now the phase has come where it is the turning point for the country; from here onwards, India can become either Italy or China. These times are extremely essential for Indian economy and in order to release the country from the grip of COVID-19, Indian pharma sector has an important role to play. This sector is bound to enjoy investor confidence at this time as it will play an important role in preventive measures. Due to increasing government intervention in this sector, investors will surely look up to this as a profitable investment opportunity. Moreover, an increase in centers for testing the disease would increase demand for equipment as well as help controlling the spread of the virus. The race of developing the vaccine has already begun and once it is done, and it will surely bring fortunes for pharmaceutical companies. Talking of Indian markets, in times like these where supply is not adequate enough to raise the demand, monetary policy loses its power, so everyone is expecting fiscal measures from FM Nirmala Sitharaman which will hopefully serve the purpose.

With these trends in the past month, the trend line shows that it is been on decreasing line.

In the beginning the pharma sector had witnessed a growth potential gaining the investors’ confidence which seems to go down since the supply shortage. But the picture is likely to improve due to the following reasons. India is committed to spend nearly Rs 10,000 crore ($1.3 billion) to encourage companies to manufacture pharmaceutical ingredients domestically after the coronavirus outbreak disrupted supply chains. Lockdowns in china have started to ease which help resuming the business activities in India. Along with this, domestic firms will be revived which had previously shut down due to low cost imports from china. This will in turn ease out the burden to a large extent. In the wake of recession, it won’t be long until investors start looking at pharma stocks for future investments.

With the pandemic strengthening its grip in India, now the phase has come where it is the turning point for the country; from here onwards, India can become either Italy or China. These times are extremely essential for Indian economy and in order to release the country from the grip of COVID-19, Indian pharma sector has an important role to play. This sector is bound to enjoy investor confidence at this time as it will play an important role in preventive measures. Due to increasing government intervention in this sector, investors will surely look up to this as a profitable investment opportunity. Moreover, an increase in centers for testing the disease would increase demand for equipment as well as help controlling the spread of the virus. The race of developing the vaccine has already begun and once it is done, and it will surely bring fortunes for pharmaceutical companies. Talking of Indian markets, in times like these where supply is not adequate enough to raise the demand, monetary policy loses its power, so everyone is expecting fiscal measures from FM Nirmala Sitharaman which will hopefully serve the purpose.