SPACs: What’s the hype all about?

Sateesh Chandra

Have you ever invested in a company? If yes, then which factors do you consider evaluating before an investment? Well, if you ask me then I would say that the basic factors one would look after are, the company’s activities, track record and financial performance among others. But what if I tell you that the company doesn’t have any particular commercial activity to perform, nor does it have any assets or track record? Confused? Well, then you might have not heard of SPACs. SPAC is an abbreviation of Special Purpose Acquisition Company, popularly known as Blank Check Companies. These companies do not have any particular commercial activity to perform. Their main motive is to raise funds through Initial Public Offerings (IPOs) and then inject these funds into any private business entity by merging with that entity.

How does a SPAC work?

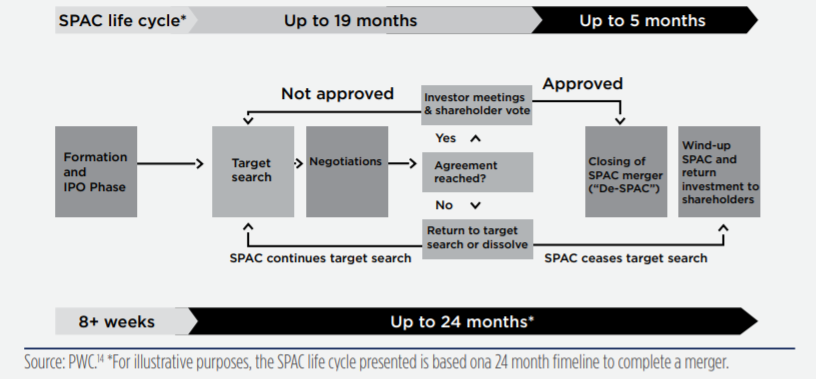

After knowing what a SPAC is, you might be wondering how this specific type of company works. A SPAC is formed by a group of professionals known as sponsors. These sponsors after forming a SPAC offer units through IPOs. A unit typically contains a share and a warrant or a partial warrant. A warrant is a contract that allows the investors to further purchase a certain quantity of the common stock at a certain price in the future. These units usually cost around $10. Investors, individual or institutional, invest in SPACs by purchasing these units. A SPAC then finds a private entity to merge with within 24 months, i.e., 2 years. Now obviously no one wants to keep their money idle for two years, so the SPAC deposits the money raised through IPO in a trust. These trusts deal with basic money market instruments or government bonds. More often than not, the interest earned on this investment is used as the working capital of a SPAC.

What if a SPAC is not able to merge with a private entity? The answer is simple- the SPAC gets dissolved. In this process of dissolution, the entire amount in the trust is distributed to the investors in proportion to their holdings.

The above chart shows the brief timeline of a SPAC from its IPO to the end of its tenure.

What’s in store for Stakeholders?

A traditional IPO is a company looking for money, while a SPAC IPO is money looking for a company. This creates an interest among the investors, the sponsors, and the private company in several ways.

Benefits to the Investors:

What makes SPACs so attractive to investors is the ability to have a say in the investment decision, which is lacking in the venture capital world. Investors here get the chance to use their warrant and get more common stocks once the SPAC decides to acquire a certain company, or opt-out of the deal and get a reimbursement of their investments. This makes SPACs a somewhat risk-free investment for careful investors.

Benefits to Sponsors:

SPACs are lucrative not only for the investors but also the sponsors, who commonly receive about 20% of the SPAC’s shares for sponsoring the company in its initial stages. This set percentage of shares provided to them is known as a “promote”.

Benefits to the Private Company:

For a private company, the benefit of going with a SPAC instead of an IPO is two-fold. Firstly, it has a faster execution, taking only 3-6 months, compared to an IPO that could take anywhere from 12-18 months. Secondly, rather than waiting and speculating the price of their share at the time of the IPO, the company has the power to negotiate the pricing with the SPAC before the deal is made, thereby giving them an advantage, especially in volatile markets.

Why all this hype now?

SPACs have been in existence for decades now, but these have become popular in the last few years. Initially, SPACs had a negative impression of scamming investors. However, regulations have been increased to reduce fraud. Now investors have an option of redemption before the company merges with a private entity, i.e, an investor can opt to pull out his money if he is not interested in the acquisition. The investors are often entitled to voting rights, which can be availed if the investors are not satisfied with the acquisition.

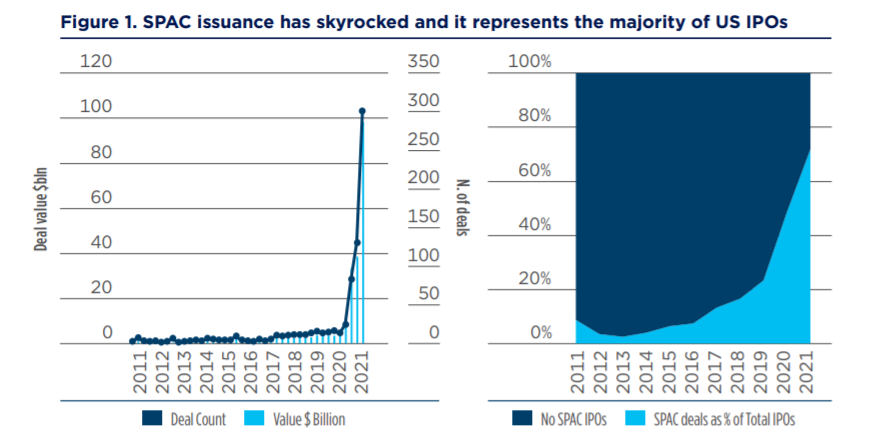

The incidence of SPACs in recent years is skyrocketing and the SPAC as a percent of IPOs launched in a year in the US markets is on the rise. Virgin Galactic, DraftKings, Opendoor, and Nikola Motor Co. are famous companies that have adopted the SPAC route for going public. According to Renaissance Capital, around 200 SPACs went public in 2020, earning about $64 billion in total capital, nearly as much as all of last year’s IPOs combined. The graphs below show the colossal growth of the SPAC market.

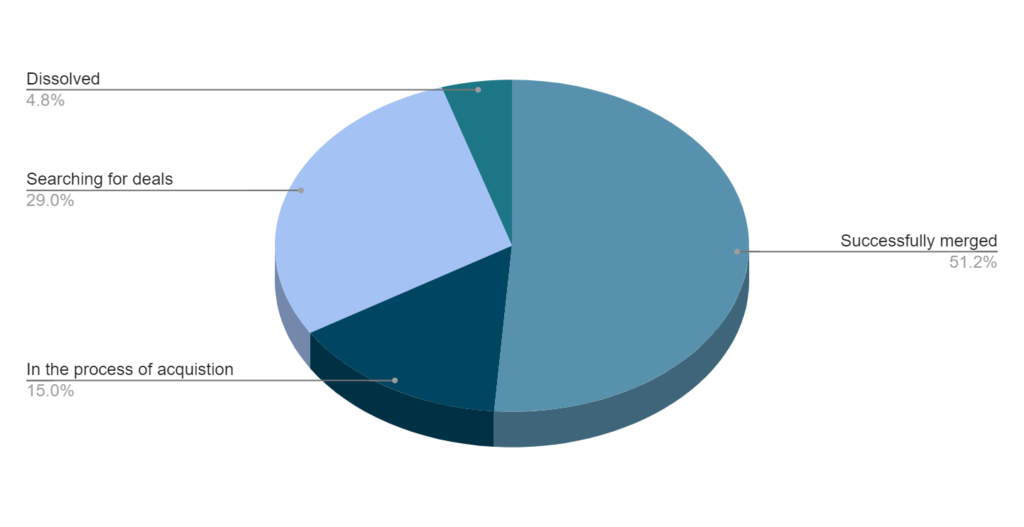

As we understand the growing importance of SPAC in the IPO market, it is also important to note that not all SPACs are successful. Investors should carefully differentiate the gold from the glitter. There is high validation from high profile investors concerning the losses realized in immature SPACs. A study from 2010 to 2017 followed 92 SPACs and found that they underperformed the broad market by 3%. Another study between 2015 and 2019 found that the majority of SPACs were trading below the $10 IPO price and concludes the following data on the success of SPACs.

By now you would have realized that a SPAC is a thorough combination of opportunities and obstacles. Any misguided decision will cost the investor a fortune.

Regulatory Stance in India:

Despite the numerous advantages unfolded with a SPAC, the Indian regulation doesn’t recognise it as a legal entity. Soon after demonetisation, the Indian Government turned a hard nose on shell companies, and SPAC being regarded as a shell company with no corporate action, faces hurdles from both the Companies Act and SEBI regulations. According to the Companies Act, 2013, If a company does not commence business operations within 12 months of its incorporation, the Registrar of Companies can remove the firm’s name from the registration. And according to SEBI regulations any company willing to go for an IPO should meet the following conditions:

(i) Net tangible assets of at least Rs 3 crore for the preceding 3 years.

(ii) Average operation profits of the corporation must be at least Rs 15 crores during the preceding three years.

(iii) The net worth of the corporation must be at least Rs 1 crore in each of the preceding years.

SPACs fail to fulfil these conditions as they do not have any commercial activity in place for the initial two years. However, after the rising recognition of SPACs by developed economies like the United States of America, England and Australia, the Indian regulators are planning the inclusion of SPACs in the country. SEBI convened a panel of experts in March 2021 to look into the viability of establishing SPAC-style structures in India.

What to analyze while investing in SPACs?

Having read all this, every investor would be curious to know what all factors should be evaluated before investing in a SPAC. The following fundamental factors, if evaluated critically, provide a strong rationale for the investment.

Current Phase:

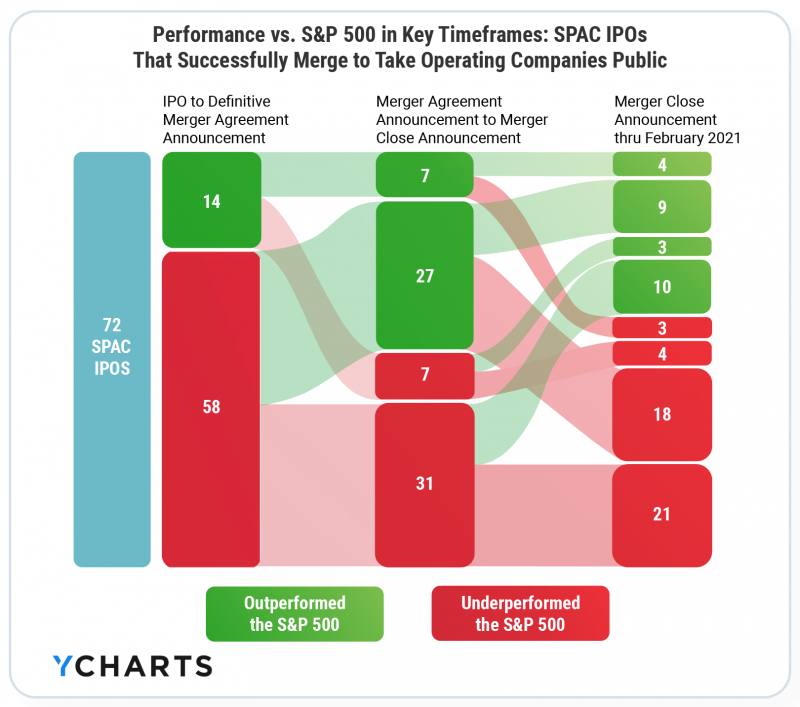

Every SPAC is divided into three phases from an investor perspective. They are as follows:

- SPAC IPO to the announcement of a Definitive Merger Agreement

- Announcement of a Definitive Merger Agreement to Announcement of Completed Merger

- Post announcement of Completed Merger

The performance of the SPACs sway distinctly in these three phases. A study on lifetime performances of 72 SPACs showed that the performance is best when a SPAC reveals its merger target before the merger is finalized, indicating that investing on speculation and hype is frequently rewarded, if only temporarily. Hence investing in the right phase of the SPAC is crucial. The following chart compares the performance of SPACs with S&P 500 during its three stages.

Management Team:

Think of it this way, SPAC typically doesn’t have any product, track record, or any asset, then what upon an investment decision could be based? Yes, it is the Management team, also known as sponsors. A SPAC investor is directly betting on the management capabilities. Hence, the better the management is, the brighter the results will be. Some high profile SPAC managers are Chamath Palihapitiya, a former Facebook executive; Bill Ackman, a famous hedge fund manager. All that investors could hope for is that sponsors strike pay dirt once again, and take the investors with them.

Statutory Filings:

Like any other investment, statutory filings like SPAC’s IPO prospectus could be a good start for investment analysis. Also, investors can refer to the periodic and current filings to get a birds-eye view of the company’s functioning.

Target Company:

After all, the main purpose of the SPAC is to merge with a target company. So, a keen analysis of the target company is important if an investor plans to enter the game in the second phase. In the regular IPO model, the company goes public only after thorough scrutiny. For example, WeWork failed to go public because of numerous irregularities in the company and its management. The SPAC route to go public isn’t grinding on part of the target company. Thus, investors should remain wary of any discrepancies.

Going public through SPACs is being considered by an increasing number of companies, and the current hype is making it all the more enticing for younger startups. However, as an investor, given SPACs’ relative newness and the fact that most SPACs are structured in such a way so as to leave the investors holding most of the risk, you should be wary of making any serious investments and thoroughly evaluate the opportunity cost of including such a risky investment in your overall portfolio strategy.

References:

https://www.nasdaq.com/articles/examining-spac-performance-pre-post-merger-2021-04-23

file:///D:/2021.05%20-%20SPACs%20-%20EN.pdf