Inflation Risk? Check.

Tanisha Singh

An amount of Rs. 1000 in 2010 is equivalent to Rs. 1854 in 2021. This means that today we require close to Rs 2000 to buy the same amount of things we could easily buy with Rs 1000 in 2010. This is due to Inflation, which is defined as the general rise in the price level of an economy hence indicating the decline in the purchasing power of a currency over time. It is the rate at which the real value of an investment erodes and the investors have to bear losses in the form of a decline of purchasing power. And people who let their money sit idle suffer even more losses. Currently, the inflation rate in India for August 2021 was 5.3% and is within RBI’s target of 2-6% amidst the Covid-induced lockdown supply.

Inflation affects the investments of many investors. Their returns can sometimes be destructive as they look at only the nominal returns while inflation keeps on eroding their money silently. Real return is the amount earned after adjusting for inflation. So, the purchasing power of investors can only improve if they target the returns above the rate of inflation i.e. real returns. Suppose if the inflation rate is 3% for a year, then the target of returns should be over 3% so that the investor isn’t in a vulnerable position in the future.

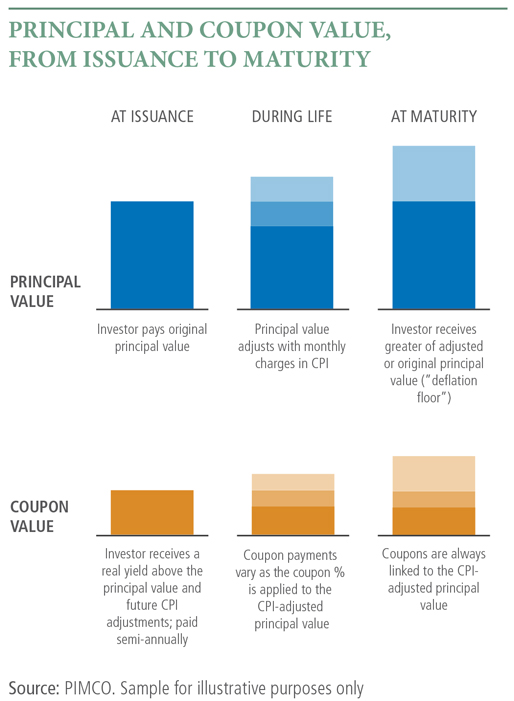

To protect investors from the risk that inflation poses, there are certain instruments. One of them is Inflation-indexed securities which offer higher returns than the rate of inflation. In India, Inflation-Indexed Bonds(IIBs) have been issued by the RBI since 2013. The principal amount and interest payments of these bonds are linked to the Consumer Price Index (CPI). This means that even if there is inflation, it will directly lead to an increase in the principal and as a result, an increase in the interest as well. This safeguards the investors from the threat of inflation. Even if there are deflationary trends in an economy, returns on IIBs are guaranteed by the government at a pre-decided floor price. Due to such a low amount of risk possessed by these securities, the returns offered by them are also less as compared to other instruments. Investors generally include them in their portfolios because everyone is exposed to inflation and needs some sort of relief. Since all other instruments can be adversely affected by inflation, IIBs are a handy way to mitigate that risk as they are immune to the potentially devastating effects of unexpected expansionary trends .

The first IIBs were issued in Massachusetts in 1780, after which the UK issued the first “linkers” in 1981. The government bonds are known as “gilts” in the UK and are issued by the UK Debt Management Office. Other countries followed suit. The U.S. Treasury Issued the first IIBs called Treasury Inflation-Protected Securities (TIPS) in 1997. Though India had launched propper IIBs which protect both the principal and interest in 2013, it had previously launched Capital Indexed Bonds in 1997. As of 2019, government-issued inflation-linked bonds contribute over $3.1 trillion in the international debt market.

IIBs help investors by insulating them against inflation while providing them a fixed long-term real yield. From an asset allocation point of view, IIB is a strategic bargain for investors to diversify their portfolios and gain benefits during times of uncertainty. Moreover, IIBs pose to be advantageous for the issuers as well. They help in balancing the government’s real funding costs, and eliminate the inflation risk premium on some amount of their debt as well. Additionally, IIBs also provide policymakers with inflation expectations and real interest rates which in turn helps them assess the working of the central bank. These serve as a cheap source of funding for the government and in turn, they also reflect the state’s commitment towards inflation control.

However, they bear some risks as well. IIBs are highly volatile. This is mostly because they are issued for very long periods of time. Another negative factor is the illiquidity involved as the inflation-linked securities market is still not voluminous. Also, if the economy undergoes a period of deflation, the principal can decline below the par value. The interest payments therefore will be based on the amount adjusted due to deflation. However, this is taken care of by many countries who offer a floor price at maturity in such cases. Occasionally, IIBs can turn out to be costly for the government. For instance, when the actual inflation may turn out to be higher than the expected inflation, the government will have to pay the investors more.

Even though IIBs seem like a risk-free profitable option, it is necessary to compute their relative value so as to make the correct choice for investment. This can be done by computing the breakeven inflation rate. The breakeven inflation rate is the difference between nominal yields and real yields with the same time to maturity. It is the rate at which returns from IIBs and nominal bonds are equal. This rate can determine whether nominal bonds will provide more returns or IIBs. If the inflation rate is greater than the breakeven inflation rate, then IIBs are more profitable. However, if the inflation rate is lower, then nominal bonds are more lucrative.

For example, if a 10-year nominal bond is yielding 4% and a 10-year IIB is yielding 1%. Then the breakeven inflation rate is 3%. If the inflation rate is believed to be above 3% in the next 10 years, then the IIB would be a fruitful investment.

Now Inflation-indexed securities are issued not only by governments but many financial institutions furnish them as well. These institutions issue Corporate Inflation-Linked Securities(CILS). The benefit provided by them is the same i.e. safeguarding investors against inflation, but here the coupon rate varies with a measure of inflation. Consequently, during inflation, the coupon rate of the CILS will increase and during deflation, the coupon rate is lowered. They, being similar to IIBs, also provide diversification in a portfolio as they have a low correlation with other asset classes. However, the number of issuers for these is so small that it’s cumbersome for investors to find CILS. This is mainly because the government-issued IIBs took a long time to develop, and hence the establishment of the corporate offerings are being deferred.

In conclusion, there are several securities that offer protection from inflation and investors should make mindful decisions based on the returns they aim to achieve while mitigating the risks.